The global space economy is thriving, with the satellite industry continuing to dominate. According to Hughes, in 2021, the satellite industry generated approximately $278B out of a total global Space Economy of $386B. Low Earth Orbiting satellites, which orbit close to the Earth’s surface, are a major driving force behind this growth. These satellites deliver low latency, have a short orbital period, and are relatively cheap to build and launch. Here is a look at the projected growth for the satellite market and what satellite trends are likely to have the biggest impact on the industry’s future development.

What Is the Projected Growth of the Satellite Market?

According to the Satellite and Global Market Report, the satellite market had an estimated value of $2.34B in 2022. It is forecasted to grow at a compound annual rate of 16.9%, almost doubling to $4.36B by 2025.

Additionally, the UCS Satellite Database reports that as of spring 2022, there are currently 5,465 operational satellites orbiting the Earth. Approximately 4,700 of these are low-earth orbit satellites. More and more satellites are launched every month, with about 140 successful satellite launches as of October 2022. If the satellite market continues at this rapid rate, it is estimated that there could be more than 100,000 satellites in the sky by 2030.

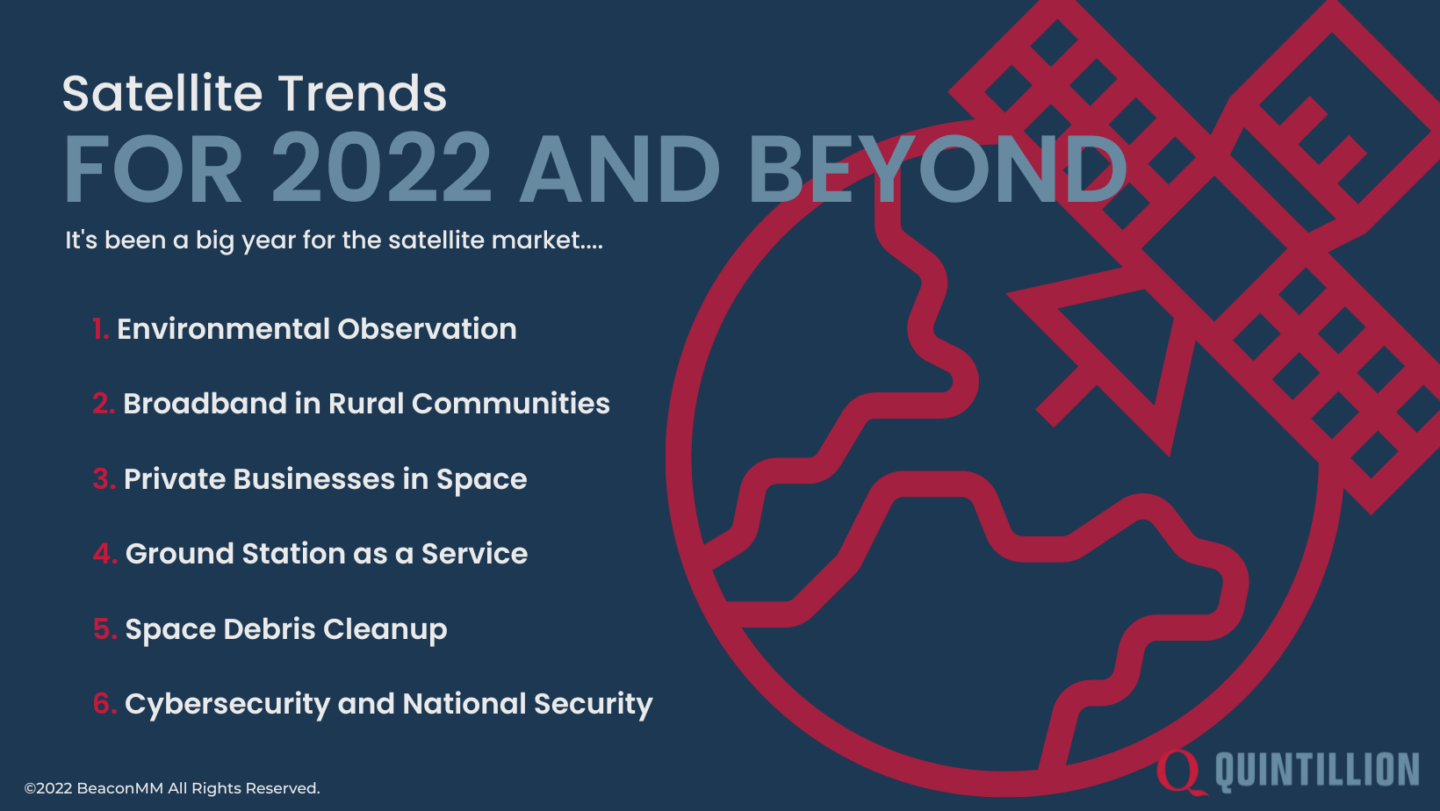

Key Emerging Trends for the Future of the Satellite Market

2022 was a major growth year for low earth orbit satellites. The expansion of OneWeb’s 648-satellite constellation and Starlink’s 3,558-satellite constellation were momentous events that further propelled the satellite market into the future. With new innovations and advancements in the industry over the last couple of years, satellites have seen more growth than ever before. However, with this exciting growth comes a number of new challenges.

As we continue into the last quarter of 2022 and look forward to what next year has in store, here are a few trending topics concerning the satellite market.

Enhanced Use of Satellites for Environmental Observation

Low-earth orbit satellites are an invaluable tool for scientists. Utilizing satellites, scientists can have near real-time data monitoring the globe, including forests, oceans, mountains, the Arctic, etc.

As more observation satellites are launched, scientists will be able to better predict weather conditions, monitor the impact of climate change, detect major weather crises, and track physical changes to landscapes and oceans. Observation satellites are becoming more adept at capturing vital data on Earth’s atmosphere, including having the ability to monitor air quality, ozone, carbon monoxide methane, and more.

Satellites for Communication in Rural Communities

Satellite internet has been around for decades, but satellite constellations promise to provide more reliable low-latency broadband services in rural communities around the world that currently do not have fiber infrastructure in place. The satellite internet market is expected to continue to grow as there are many people across the world severely impacted by the digital divide.

Previously, satellite internet was delivered via geostationary orbit satellites. Satellites are positioned about 35,800 kilometers, or approximately 22,250 miles, above the Earth. Satellites, on the other hand, orbit the globe at an altitude of 1,200 miles or less. Starlink satellites orbit at an altitude of just 340 miles.

Starlink is one of the most well-known broadband providers that currently have over 2,300 functioning satellites in orbit. Typical speeds offered by Starlink range between 20-100mbps download and between 5-15mbps upload. OneWeb is a strong competitor with currently 462 satellites in orbit currently offering commercial service. Amazon is also an up-and-coming competitor with their Project Kuiper with a planned 3,236-satellite constellation in low earth orbit.

These communication constellations still require the ability to downlink data to commercial or dedicated ground stations to connect to the wider internet to provide these services.

Growth of Commercial Satellite Applications

The commercial space industry has grown immensely over the last couple of years. From launching privately owned satellites to sending humans into space in a privately owned spacecraft, this is the first time in history that private businesses are playing a large role in space exploration and commoditization. Satellites and smallsats are significant factors contributing to this growth. With satellites becoming easier and cheaper to build and launch, many private companies now have the opportunity to join the space market and provide high-demand services for individuals, businesses, research institutes, and government organizations.

The “space-for-earth” economy is now primarily driven by private businesses selling a variety of services, a big chunk of which includes telecommunications infrastructure and satellites for observation and military use. Additionally, many governments – including the U.S. government – are partnering with private organizations for exploration, surveillance, data collection, Earth observation, and more.

Development of Ground Station as a Service

Another major shift in the space industry is the introduction of Ground Station as a Service (GSaaS). It can be expensive for satellite companies to purchase satellites in addition to building and maintaining a ground station. Instead, these companies can utilize a GSaaS provider to downlink data such as Atlas Space Operations. Satellite companies can even work with several GSaaS providers to expand their reach and scale their operations.

Quintillion owns and operates a High Latitude Data Acquisition ground station in Utqiaġvik, Alaska. Located at 72 degrees latitude, it is the highest-latitude ground station in the United States and provides a full suite of services, including:

- S and X band frequencies (with K band in planning)

- Equipment colocation

- Power

- O&M services

- Backhaul solutions

With an ever-increasing dependency on satellite ground stations, from a national security perspective, it is vital that a fully US Owned and Operated high-north ground station is being used for mission-critical traffic in the arena.

Growing Concerns Around Space Debris and Congestion

While a growing swarm of new satellites in the sky greatly benefits those living on Earth, many are concerned about the impact an influx of satellites might have on space, astronauts, and satellite companies. Navigating these issues will continue to be a key topic in the following years.

Space debris, which often includes dead satellites or pieces of rockets and other infrastructure humans have sent into space, might increase the chance of collision. And while satellite collisions are very rare, they may become more frequent as more and more satellites enter Earth’s orbit. Part of the space industry’s future growth will involve identifying and employing solutions to remove debris and minimize collisions.

Emphasis on Cybersecurity and National Security

Space defense is another significant challenge those in the space industry are facing. It is known that both Russia and China possess anti-satellite weapons that can destroy satellites in space. And while no country has ever struck down an enemy satellite, a Russian official recently threatened to strike down parts of the Starlink satellite network – a threat that no one is taking lightly.

To continue safely utilizing satellites for a wide range of applications, private and public entities must prioritize cybersecurity and physical security measures. This includes safeguarding data, utilizing American or ally-owned ground stations and data centers, and avoiding foreign components that put critical data in danger.

Want to learn more about the Quintillion HiLDA Ground Station or get more insights on current trends in the satellite industry? Contact our team to get in touch or read the Quintillion blog to stay on top of the latest industry news.